(photo credit: banspy)

What happens when the two largest stock exchanges in the U.S. become one big mega-exchange? A monopoly, that’s what! In case you don’t remember from history or economics class (or the game Monopoly), a monopoly is when one company controls an entire market, making it hard or impossible for smaller companies to fairly compete. (The market, in this case, being the market of stock markets.)

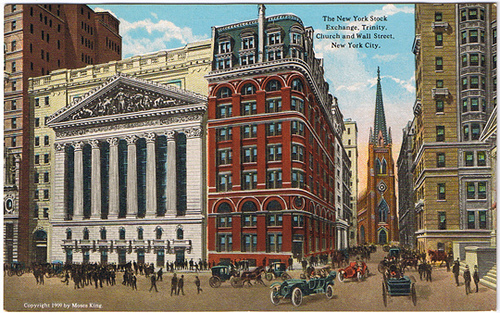

That’s why anti-trust regulators at the Justice Department have shut down Nasdaq’s attempted hostile takeover of the New York Stock Exchange. The takeover is hostile because the NYSE already has a deal with German bank Deutsche Borse to be acquired for $10 billion, and it’s so not interested in starting a relationship with Nasdaq right now.

The New York Stock Exchange and Nasdaq have been competing for years, which keeps them both in customer-pleasing, price-cutting mode. Without that competition, NYSEasdaq could charge whatever it wanted and still crush what little competition would be left.

It could even become… too big to fail!