(credit: jarapet)

How a marriage of two stock exchanges illustrates the modern revolution in stock trading.

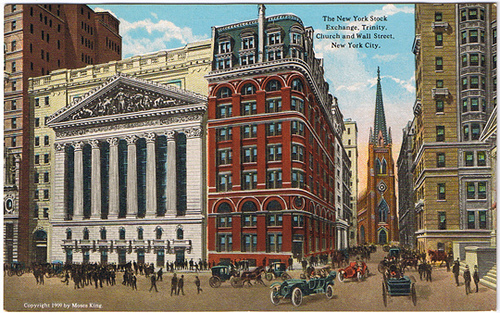

- The New York Stock Exchange – famed hall of capitalist drama – has just been acquired by a German company called Deutsche Boerse. The result will be a giant international company with stock exchanges in Lisbon, Paris, Amsterdam, Brussels, New York and Frankfurt.

- The way people trade stocks has totally transformed as technology has changed. Most trades these days are executed by computers with almost no human involvement. Since computers are smaller and cheaper than human traders, it’s possible for more small exchanges to exist, and that means more competition for giants like the NYSE.

- The NYSE still operates a real trading floor with real people, making it ancient by today’s standards. Fewer companies are bothering to even get listed on the NYSE. This merger is an attempt by the exchange to stay competitive in an increasingly crowded industry.

- Still, the trading floor, the opening bell, and that building on Wall Street are worth something. In fact, according to the latest valuation, they’re worth about $10 billion.

Facts & Figures

- The NYSE has been on Wall Street since 1792, when 24 merchants traded stocks under a buttonwood tree (you know, back when there were trees on Wall St.)

- The new company formed by the merger will be 60% owned by Deutsche Boerse

- High-frequency trading (a.k.a. computer trading) accounts for about 70% of all daily trades

Best Quote

“The exchange business is really a computer business these days.” – Charles Jones, Professor at Columbia Business School, former visiting economist at the NYSE

What do you think?

Did you know that stock exchanges like the NYSE are themselves publicly-traded, for-profit companies?

How much does a name brand influence your decision to buy (or invest)?

Get to it!

Thinking about investing in stocks? Take our Risk Assessment Quiz to see how much equity you can handle.