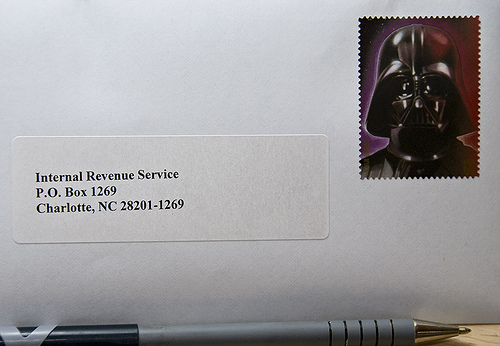

(photo credit: swanksalot)

Did you know that New York State requires residents to pay sales tax on items they order from Amazon.com?

Not at the time of purchase, because Amazon doesn’t calculate state taxes. But when you file your state tax return every year, you’re supposed to tell the state exactly how much unpaid sales tax you owe on everything you’ve purchased from out-of-state retailers (i.e., almost everything you buy online). And at the end of the year, you’re supposed to write a check for that amount.

Which, of course, nobody does. So states have been trying to pass laws requiring online retailers like Amazon, FatWallet, and Overstock to collect sales tax at the time of purchase.

Why all the sudden fuss? Well, most states are facing multi-billion-dollar budget deficits these days, and unpaid sales tax on online purchases could add up to more than $10 billion this year. Aside from selling the local park to a private company, taxes and traffic tickets are really the only ways a state can hope to raise the money it needs.

When you’re low on cash, don’t you suddenly start thinking about all the money that’s owed to you?

Click here to learn about hidden taxes, tax evasion in Switzerland, and tax breaks for do-gooders.