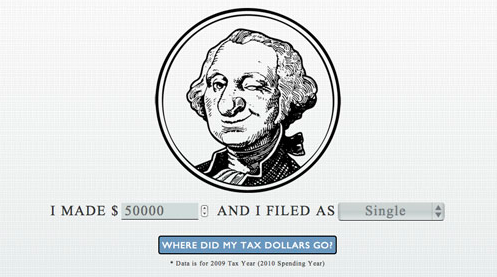

This is a pretty neat Eyebeam/ Google project. They offered money and fame (okay, just money) to the person who could come up with the best way to help you understand where your tax dollars are going, and then had a jury full of design types choose the best.

Click here to play with the “Grand Award Winner” of the interactive visualization competition, and see the rest of the winners and finalists here.

You just enter your approximate yearly income and your filing status, and the site estimates how much federal tax you’ll pay based on what tax bracket you’re in. Then it breaks down where all of that tax money you pay during the course of a year actually goes. For example, do you know how much of your paycheck goes toward funding the Department of Agriculture?

Do you even know what tax bracket you’re in? (If you don’t, you can find out here.)