(credit: mandolin davis)

Your spending habits have changed in the past month, haven’t they? If you’re in the Northern hemisphere, you’re probably entering something called “summer,” which is a sure sign that wallets are creaking open after a long winter. Why? Well, basically, the days are longer, the sun is shinier, the calendar is overflowing with vacation days, and people are just generally having more fun. Which means more ways to spend that cash!

But it’s not just summer that has us pulling out our credit cards like a bunch of capitalist lemmings – the entire world economy changes with the seasons, and your money habits are a bigger part of that than you may think.

So here’s how it usually goes:

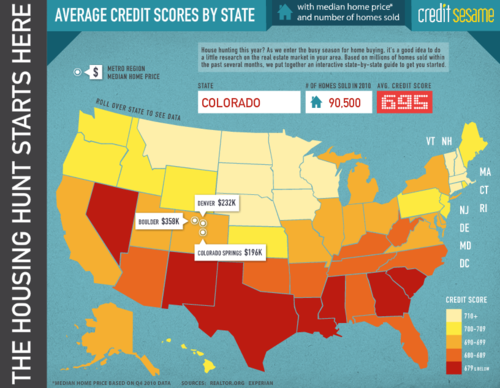

Spring & Summer = Spend

Besides the obvious expenses, like vacations and the new clothes you need now that you’re actually leaving your house in broad daylight, the warm-weather months just seem to tap into a spendy part of our brains. At least one study suggests that consumers consume more when they’re exposed to more hours of sunlight. Because they’re happier. And happy people like to buy stuff.

Fall & Winter = Grow

More specifically, Summer = sell stock & go on vacation; Fall & Winter = buy stock & hope it performs

There’s a saying on Wall Street – “Sell in May and Go Away.” It refers to a pattern of higher stock market returns from November to April and lower returns from May to October. So if your stock has done well all winter and you’re pretty sure it’s going to dip in the spring, you want to sell while it’s still high. And if you think the price is going to skyrocket again around Thanksgiving, you’ll want to snatch it up while it’s still low. Get it? Interestingly, no one can explain this pattern. (Though plenty of people are trying.)

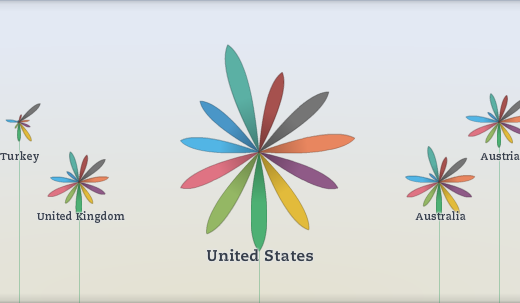

December = Give

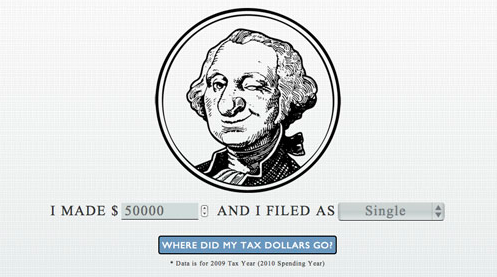

December is hands-down the biggest fundraising month for charities. Not only are people swept up in the generous holiday spirit (and probably feeling a little guilty about all the money they’re spending on pie and presents), but December is the last time to make tax-deductible donations for the year. And since many people don’t give much (or at all) during the rest of the year, the last week of December is when nonprofits see most of their donations pour in.

Everyone has a different reason for giving in winter, but a common one is that donors are busy going on vacation and spending money on themselves in the spring and summer. And who knows? Maybe there’s something about the bitterness of winter that makes people think more about world suffering.

But that’s just most people.

Do you see your own money behavior in any of these trends? More importantly, do you want to make your financial decisions based on the weather? After all, charities depend on donations year-round, and we all know you can’t really time the market.

If you’ve been unconsciously following the crowd, ask yourself: is this how you want to spend (grow, and give) your summer?