Maryann Fernandez is the founder of Philanthropy Indaba – an organization that makes giving an unforgettable experience for philanthropists of all ages. She sat down and told us a little bit about an awesome documentary film trip to Ghana that Indaba has put together for the next generation of philanthropists.

Archive for the ‘TILE Blog’ Category

Bringing Gen Y to Ghana

Monday, June 20th, 2011Bulls Start to Sniff Around African Economy

Friday, June 17th, 2011

(photo credit: ヘザー heza)

A company named Helios just unveiled its second big fund composed of equity investments in African securities. The entirely private-equity fund is the largest ever created in Africa, and it seems to show that investors are becoming more and more interested in the emerging markets there.

The idea behind investing in “emerging markets” is kind of the same as the idea behind buying low and selling high. Sure, there’s always the risk that a low-priced stock means it’s a bad company and you’ll lose money on your investment. But if the stock does well, you make money. Lots of money. Same deal with emerging markets.

Since investors are basically amateur fortune-tellers, constantly trying to predict how companies and markets will perform in the future, this new investment in Africa means that someone, somewhere, thinks that things are about to go really well in those emerging markets.

Stay tuned…

Here Come the Investomers…

Friday, June 17th, 2011

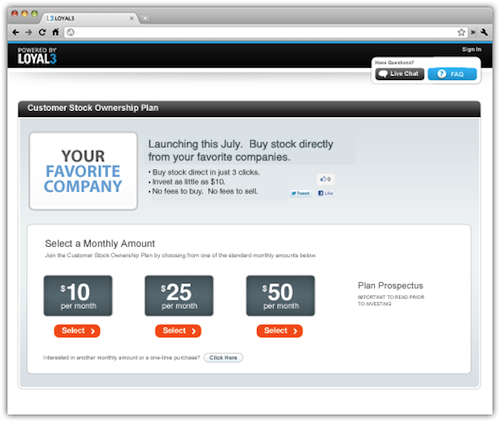

(image from loyal3.com)

In the very near future, you’ll be able to buy stock in a company you like by clicking three times within a Facebook app. Yes.

The start-up behind this investing revolution is Loyal3, and its goal is to make a boatload of money. But its other goal is to make it easy (and free) for average people to buy stock in the companies they like. And its other other goal is for companies to make it easy (and free) for average people to buy stock in their company, and thereby earn more loyal customers. Er, investomers.

Amazing, right? The Internet and mobile technology have already revolutionized philanthropy – now anyone can donate $10 instantly with just a text message – so it was only a matter of time before the financial industry got in on the action. (Ahem.)

But this guy is a little concerned about making “mindless” investing available to the next generation. Why encourage people to buy stock without first giving them the proper tools for learning about the health of the company? Loyal3 could be a great opportunity for young investors who want to try out their growing knowledge about investing. But it could also be the next bad idea – we’ve seen the damage that can be caused by blindly handing money over to people who make promises without showing us what’s behind the curtain.

Would you buy stock on Facebook if there were no fees associated with it?

The President’s Own Budget

Thursday, June 16th, 2011

(Official White House photo)

President Obama was recently caught off guard when a personal finance reporter asked him a question about his budget. No, not that budget. His family budget. A U.S. president earns about $400,000 a year, not counting outside income. And while he probably pays someone smart to help him make major financial decisions, he’s still got to have some basic money management lessons to teach his kids.

So what kind of advice does our nation’s leader have for financially illiterate citizens?

Save part of your paycheck and believe in the power of compound interest.

His answer was so simple… it was kind of disappointing, really. Isn’t there some secret to achieving financial control? A magic formula? Hot stock tips? No. Well, at least, not according to the president.

Interesting. How far could compound interest take you? SPEND.GROW.GIVE. members have access to a neat compound interest calculator on the site, but you can use this lamer but still functional calculator to find out.

Don’t Give Up!

Wednesday, June 15th, 2011

(photo credit: Caro Wallis)

Good news, Unemployed College Grads of America. Go get your mom. We’ll wait.

You know how hard it is to find a job these days, even with that fancy (and expensive) college degree? If you read the news, which is what you must be doing with all the free time you have, you might think that your career and your entire future are slowly crumbling with every rejection letter.

But it turns out that this isn’t the first time grads have been stuck in a recession hiring slump. And you know what? The grads who were facing the same problems you’re facing today – in 1982 – mostly turned out okay. They started slow, but eventually opportunities opened up that allowed them to get into their career groove.

So stay smart, friends, and don’t lose faith.

Need another shot in the arm? Let Kathryn and Amanda take you through the virtues of accepting an imperfect first job.

The Boston Chicken Calamity: Frank Murtha Talks with TILE

Monday, June 13th, 2011Even experts in investor behavior make stupid mistakes sometimes. Let’s all learn from Frank Murtha, financial psychologist at MarketPsych:

Progress in Genetic Testing Leads to a New Cancer Treatment

Friday, June 10th, 2011

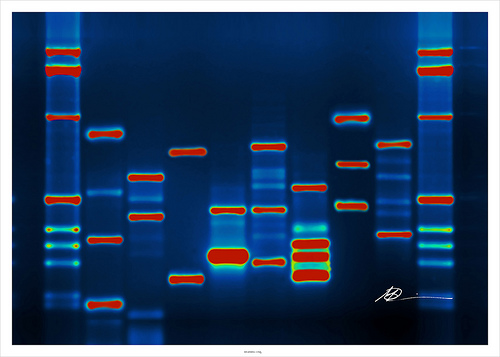

(photo credit: micahb37)

When you or someone you love develops a terminal illness, you’re often motivated to do everything you can to fight for a cure. But progress can be frustratingly slow, and it can be hard to know which projects and organizations to donate to.

But there’s a new frontier on the fight against cancer, and it’s all due to advances in DNA sequencing. Now cancer researchers are using genetic information about individual patients to engineer targeted treatments – treatments that appear to be more effective than current methods.

The treatment still has to gain FDA approval, but it’s being prioritized because of its potentially revolutionary results.

The fight goes on, of course, but this is a nice reminder that funding research and development really does get results.

Tornadoes Make $7 Billion Disappear from Insurance Industry

Thursday, June 9th, 2011

(photo credit: Mike_tn)

Here’s how insurance works for you: Instead of paying $200,000 to rebuild your house after it’s been destroyed in a natural disaster, you pay $200 a year (called a premium) to an insurance company that will cover the whole bill in the event that such an unfortunate thing occurs.

Here’s how insurance works for insurance companies: A lot of people pay you $200 a year for protection against the very unlikely possibility that their house will be destroyed in a natural disaster. You profit.

(Of course, you have a team of people with calculators and maps who spend every single day figuring out the likelihood that your customer’s house will, in fact, be destroyed in a natural disaster. If the odds look good, you’ll either charge them a higher premium or refuse coverage altogether.)

Here’s what happened between May 20th and 27th: Hundreds of tornadoes destroyed $7 billion in property, which the insurance companies now have to pay for. That makes 2011 the most expensive year EVER for these companies.

But… better them than you, right?

Addicted to Risk

Thursday, June 9th, 2011

(photo credit: jeroen_bennink)

When you have a lot to lose, how likely are you to engage in risky behavior?

Apparently people with a lot of money to lose – people known as “the wealthy” – are pretty likely to take those risks. But not simply because they can afford to lose here and there. Many of them are just hard-wired that way.

At least, according to this study by Barclays Wealth. We definitely don’t endorse trying to make money by taking excessive risk or doing things like trying to time the markets. But, interestingly, neither do the millionaire risk-takers themselves. Most of those who reported trading more often than they should also reported feeling guilty about it – and slightly out of control.

Surprising, right?

What’s your risk tolerance? Find out by taking our Risk Assessment Quiz!

The Way to an Investor’s Heart is Through His Wife’s Closet?

Wednesday, June 8th, 2011

(photo credit: fimoculous)

If you were a major luxury fashion house going public in an attempt to raise $3 billion from Asian investors, would you spend hours working on your investor PowerPoint presentation, or would you wrap a bunch of models in snakeskin and have them walk around at the Plaza Hotel?

Guess which way Prada went?

The Italian company is pursuing an IPO, which means it’s going to sell off pieces of itself to public investors, in Hong Kong this month. In order to woo potential investors, it held a relatively small fashion show for tycoons and their wives and daughters. Female tycoons either didn’t exist or were mysteriously lost in the editing of this WSJ piece about the event.

Prada is valued at $15.7 billion, so with this initial public offering, they’re giving up ownership of almost 20% of the company. But they’ve got to raise that cash somehow if their plans for world fashion domination are going to work out.

In other news, here’s a handy list of some of the biggest IPOs in U.S. history.

Hey, investor. Would YOU be wooed by a runway show?