(photo credit: Pink Sherbet Photography)

Looks like you’ll have to literally keep up with the Joneses these days…

(photo credit: Pink Sherbet Photography)

Looks like you’ll have to literally keep up with the Joneses these days…

Evan Piekara is an alumnus of Teach For America, a national organization that works to ensure educational opportunities for students of all backgrounds. During his 4 years as a corps member, he taught 6th and 7th grade in the South Bronx. He’s also worked as an Institute Staff Member, helping to train the 2008 and 2009 corps. As a result of his classroom experiences, he developed some interesting views on education in America and the importance of gaining financial understanding at a young age.

Evan Piekara is an alumnus of Teach For America, a national organization that works to ensure educational opportunities for students of all backgrounds. During his 4 years as a corps member, he taught 6th and 7th grade in the South Bronx. He’s also worked as an Institute Staff Member, helping to train the 2008 and 2009 corps. As a result of his classroom experiences, he developed some interesting views on education in America and the importance of gaining financial understanding at a young age.

TILE: What inspired you to become involved with Teach for America?

Evan: I was inspired by its mission that all children deserve an excellent education, and the fact that TFA works tirelessly to ensure that your income level or where you grew up does not determine your future.One thing that has always impressed me about TFA is that it is constantly looking to improve and become more effective. It has both a short-term strategy of getting people involved in education who may not have entered in the first place with a long-term mission of them using these experiences whether as teachers, business leaders, lawyers, doctors, politicians, or advocates to continue to support the mission and improve education for all.

TILE: What qualities do you look for in teachers who become part of your organization?

Brett Molé from Minyanville had just finished eating his daily $175 hamburger topped with 750mg of gold flakes when he had the idea to make this video. It’s fun!

(image credit: B Rosen)

Numbers can tell you an awful lot, even if you don’t usually think of yourself as a number-cruncher.

Here’s one way: You’ve heard of net worth. You may even know yours. But have you ever watched your net worth fluctuate over time? It’s a really easy and interesting (really!) way to see how you’re growing (or regressing) as a Possessor of Wealth.

For example, a net worth number that consistently increases is a good sign that you’re doing something right. But even a dip can be instructive. Did the recession wipe out your investment holdings? Maybe it’s time to reconsider your strategy so it doesn’t happen again. (Hint: Try diversification next time.) Did your numbers go down because you spent a lot of money on tuition this year? Watch to see if your net worth increases as a result of your education investment.

We found a cool site called NetworthIQ that helps you track your net worth over time AND snoop on a bunch of other people tracking their net worth. You can compare your progress with others by age, location, education, and job category.

Not that your net worth necessarily reflects your worth as a whole person, but knowing has to be… worth something. Worth.

(photo credit: Mark Ramsay)

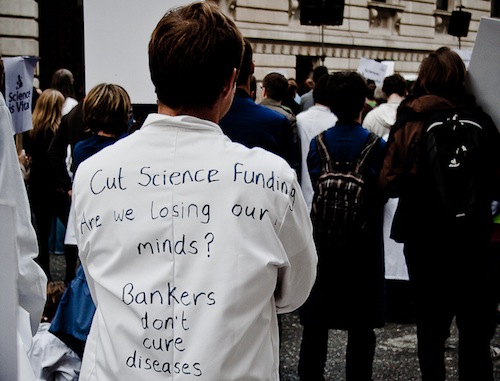

Heard of Kickstarter? That new site where anyone with an idea and a plan to make it happen can raise money from the unwashed masses? Well until now it’s mostly been used to help bands record their breakout albums, help designers raise capital to manufacture life-improving products, and help slightly off do-gooders pay for various swing-installation projects.

But now scientists are getting in on the action. From the Kickstarter-funded Mexican quail research expedition to the new academics-only crowdfunding site Open Genius, the doors are open for promising researchers to avoid the pain of securing traditional government and foundation funding.

Which means that you have a unique opportunity to directly impact research you care about. It’s one thing to donate to a cancer research fund (which is a totally awesome thing to do, by the way), but it’s another thing entirely to choose the lab you want to support.

This is also a great opportunity to exercise your advocacy muscles. With just a little prodding and a link to a well-designed website, you can double, triple, or quadruple your donation by talking to friends or posting your pitch online.

Never underestimate the power of peer pressure and one-click donating.

You may have heard about SRI, but odds are you haven’t heard the whole story. We explain it to you in about three minutes.

(photo credit: mangpages)

It’s kind of an understatement to say that taxpayers were peeved when they ended up footing the bill for the government bailout of the “too big to fail” banks. So they may take some comfort in a new FDIC rule that will seriously punish the leaders of failed financial institutions. Among other things, it says that any executive responsible for the collapse of a major financial firm is subject to spooky-sounding “clawbacks.”

Clawbacks are the equivalent of making an executive return two years worth of their salary to the government if a government agency has to step in and handle the collapse. Big banks will also be required to have a plan in place before they go up in flames, to avoid the kind of sweeping support the government was forced to provide in 2008 and 2009.

That’s a lot of pressure on a relatively small number of people. What do you think – whose responsibility is it to keep a financial institution on the straight and narrow? Should employees lower on the corporate totem pole be punished as well?

(photo credit: Toronja Azul)

We all know eating out is more expensive (and more fattening) than eating in. But how much more expensive, exactly? Intern Anna did a little experiment:

Your stomach is grumbling and you’re trying to decide – do I head out the door or hit the kitchen?

Say you’re craving a good old turkey sandwich. That’s it. And you decide to stay in rather than roam the streets. So you grab…

- 2 slices of bread ( = grainy-goodness), $0.50

- 3 slices of turkey, $0.60

- 1 slice of cheese (the nice stuff), $0.35

- a bit of lettuce, $0.10

- 2 slices of tomato, $0.20

- a squeeze of mustard, $0.05

You’re all set and the total is… $1.80! Head to the local deli or grab a pre-packaged sandwich and you’ll probably be paying $5.00 – or more.

One New York City native really took the plunge and decided to only eat in – ever – and she wrote a book about her experience. She’s still blogging about not eating out in NY.

If you keep sweaters in your stove and have a taste for the gourmet, eating out might be a priority for you. But if you’re not opposed to spending more time waltzing down the grocery store aisles and dancing in the kitchen, eating in could keep your piggy bank nice and heavy.

(photo credit: j thorn explains it all)

So much talk about the debt ceiling, so little explanation. The “ceiling” in this case is the limit of how much debt the U.S. government allows itself to take on. That’s why it’s up to Congress to decide what to do now that we’ve pretty much hit that limit. They can raise the roof and make it okay to go deeper in debt, or they can refuse, and the U.S. won’t have enough money to pay off some of the debt it already has.

But what does that mean to you? Conveniently, our friends over at Marketplace have explained why the debt ceiling is important to the average American in “How the debt ceiling affects the average American.” They use an actual example of an actual average American, who emerges from the conversation pretty shaken. (One side effect of the debt ceiling problem is that it freaks people out and makes then snap their wallets shut – otherwise known as shaking consumer confidence.)

Anyway, if Congress doesn’t agree to raise the debt ceiling, then the U.S. government won’t be able to pay its creditors back as promised. And just like a person who takes out a loan and then doesn’t pay it back, a default will lower America’s credit score (or credit rating, which is the national equivalent of a credit score). And with lower credit ratings come higher interest rates on future loans. After all, the bank is taking a bigger risk on you because you’ve shown in the past that you’re not the most reliable borrower. So they’ll let you borrow – but you’ll have to pay.

So what does this have to do with us average Americans, you ask with vague irritation? Well, generally what happens when interest rates increase for the government is that interest rates increase for everyone. So if you wanted to get a loan to buy a car or a house, you would end up paying a lot more for it. And if you have any credit card debt, those interest rates will go up, too. So instead of paying an extra 18% or 30% on the balance you’re carrying month to month, you’ll be paying something frighteningly larger.

Everyone gives for their own reasons – compassion, anger, or sometimes just the tax deduction. But some people have personal experiences that change them forever – and compel them to fight for a cause they truly believe in.

Brett Kopelan is the Executive Director of Debra, a charity that funds research for a terrible disease called Epidermolysis Bullosa (EB for short). Debra also runs programs that help families whose children are afflicted with the disease. Brett has an M.A. in Child Psychology from Columbia University and a daughter with ED. His personal experience with the disease inspired him to make it his life’s work to combat the disorder and support families like his own.