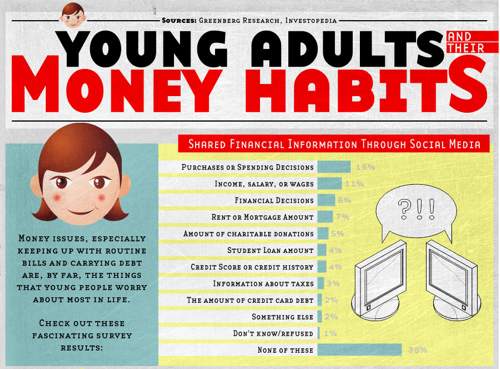

Today at TILE, we talked about the prospect of deflation in the economy. Is it really happening? Why does it seem economists and the markets keep changing their minds on the subject? What can even be done about it?

Imagine you are camping in a forest and you’ve made a fire to cook with – if it gets out of control, everything burns up and eventually you’ll have a problem on your hands. That’s kind of like rapid inflation. But if it burns out, you’ll end up cold, hungry, and probably pretty miserable. That’s more like deflation, and if there’s too much, it can be really hard to get that fire going again. In the world of economics, the goal is to have slow and steady growth – not too much and not too little. In other words, inflation is when the economy “heats up” – prices rise faster than the value of the currency being used to purchase goods and services. In contrast, deflation is when the economy “cools off” to the point where the world becomes too sluggish – prices of goods and services even start to contract, such that a vicious spiral of non-growth or negative growth can overtake us all.

(more…)