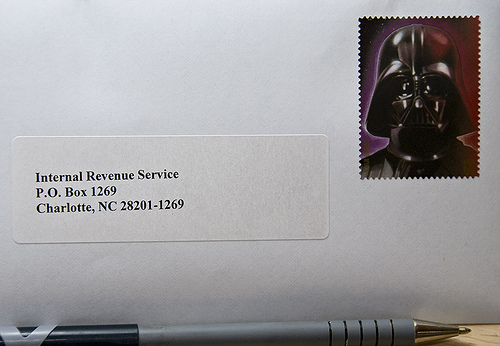

(photo credit: Evan Prodromou)

We all know that carbo-loading is essential for running a marathon (or staying up all night writing papers/ playing video games). So why expect lasting social change to run on a cookie here, a handful of peanuts there?

“45% of the population of rural India live in villages with no electricity.” So it was only a matter of time before capitalist do-gooders found an opportunity to profit from lighting up the countryside. Providing affordable clean energy solutions is potentially a $2 billion industry in India alone. And it’s not just the entrepreneurs who profit: locals suddenly have light to study and work by, cleaner air and water, and a new job market for selling and repairing solar lanterns and other green gadgets.

Sounds like a pretty neat social venture to us. What do you think?

When it comes to supporting causes you care about, are you more likely to fund emergency projects, like disease and hunger relief, or longer-term strategies for change, like electricity?

Freddy Dico is the co-founder of Sir New York, a modern menswear label that launched in Spring 2010. He’s from Macau, but grew up in San Francisco. And before getting into the world of design, he was actually a star student in the biochemistry program at U.C. Davis. Since switching gears and graduating from

Freddy Dico is the co-founder of Sir New York, a modern menswear label that launched in Spring 2010. He’s from Macau, but grew up in San Francisco. And before getting into the world of design, he was actually a star student in the biochemistry program at U.C. Davis. Since switching gears and graduating from