(credit: Unhindered by Talent)

Guess what? Retailers are getting smarter and smarter when it comes to separating you and your cash (or credit card info, to be more precise).

First there was members-only designer discount site Gilt Groupe, with time limits for checking out with your items. Then we saw the daily deals companies like Groupon and LivingSocial. There’s Rent the Runway, where you can rent a hot little piece of couture for an event for under $200.

And now, for a mere $30 monthly subscription fee, online shops like JewelMint will get to know your tastes and offer up pieces it’s sure you’ll like. All based on an algorithm. This is in some ways even cooler than the computer from Star Trek: The Next Generation that made Captain Picard all those cups of tea with a simple voice command.

The online shopping world will surely continue to evolve, getting cooler, more convenient, and quite a bit more manipulative in the process. So don’t forget to bring your brain when you go on your next online shopping spree.

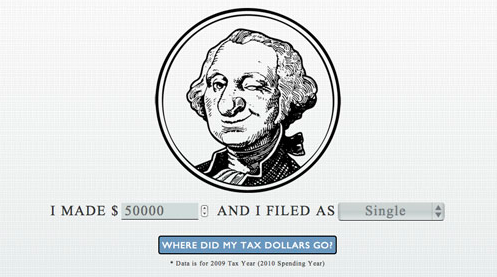

Think you’re a conscious consumer? Take our Where Does the Money Go? challenge!