A social security number (SSN) is a nine-digit number issued by the Social Security Administration to every United States citizen, plus permanent residents and temporary working residents. Its main purpose is to track individuals for taxes, but it’s also used as an official national identification number.

Archive for the ‘Spend Page’ Category

Being a Billionaire’s Daughter

Thursday, June 2nd, 2011

(© Andrew H. Walker/Getty Images)

If you’ve ever wondered what it’s like to be a kid with a horse and a dream and a billion dollar inheritance, now’s your chance to find out. Georgina Bloomberg, the 28-year-old daughter of the mayor of New York City, has just published a young adult book that is technically a work of fiction, but clearly based on her life in the inner circle of Manhattan heiresses.

While it’s not fair to read too far into Georgina’s life based on her book, there are some interesting themes – mostly around the unwanted fame that comes with wealth and good old arguments with dad. What do you do when your father’s fortune allows you to excel at an expensive sport – horse riding – but his business sensibility dismisses it as a career because it doesn’t pay?

It’s kind of nice to see that the tension between parents who want the best for their children and the children who want to follow their bliss is pretty much universal. No matter what your net worth.

Still trying to find your bliss? Watch our interviews with Pretty Young Professional or Ron from CareerCore to get started!

Spending, Growing, and Giving in Warm Weather

Tuesday, May 31st, 2011

(credit: mandolin davis)

Your spending habits have changed in the past month, haven’t they? If you’re in the Northern hemisphere, you’re probably entering something called “summer,” which is a sure sign that wallets are creaking open after a long winter. Why? Well, basically, the days are longer, the sun is shinier, the calendar is overflowing with vacation days, and people are just generally having more fun. Which means more ways to spend that cash!

But it’s not just summer that has us pulling out our credit cards like a bunch of capitalist lemmings – the entire world economy changes with the seasons, and your money habits are a bigger part of that than you may think.

So here’s how it usually goes:

Spring & Summer = Spend

Besides the obvious expenses, like vacations and the new clothes you need now that you’re actually leaving your house in broad daylight, the warm-weather months just seem to tap into a spendy part of our brains. At least one study suggests that consumers consume more when they’re exposed to more hours of sunlight. Because they’re happier. And happy people like to buy stuff.

Fall & Winter = Grow

More specifically, Summer = sell stock & go on vacation; Fall & Winter = buy stock & hope it performs

There’s a saying on Wall Street – “Sell in May and Go Away.” It refers to a pattern of higher stock market returns from November to April and lower returns from May to October. So if your stock has done well all winter and you’re pretty sure it’s going to dip in the spring, you want to sell while it’s still high. And if you think the price is going to skyrocket again around Thanksgiving, you’ll want to snatch it up while it’s still low. Get it? Interestingly, no one can explain this pattern. (Though plenty of people are trying.)

December = Give

December is hands-down the biggest fundraising month for charities. Not only are people swept up in the generous holiday spirit (and probably feeling a little guilty about all the money they’re spending on pie and presents), but December is the last time to make tax-deductible donations for the year. And since many people don’t give much (or at all) during the rest of the year, the last week of December is when nonprofits see most of their donations pour in.

Everyone has a different reason for giving in winter, but a common one is that donors are busy going on vacation and spending money on themselves in the spring and summer. And who knows? Maybe there’s something about the bitterness of winter that makes people think more about world suffering.

But that’s just most people.

Do you see your own money behavior in any of these trends? More importantly, do you want to make your financial decisions based on the weather? After all, charities depend on donations year-round, and we all know you can’t really time the market.

If you’ve been unconsciously following the crowd, ask yourself: is this how you want to spend (grow, and give) your summer?

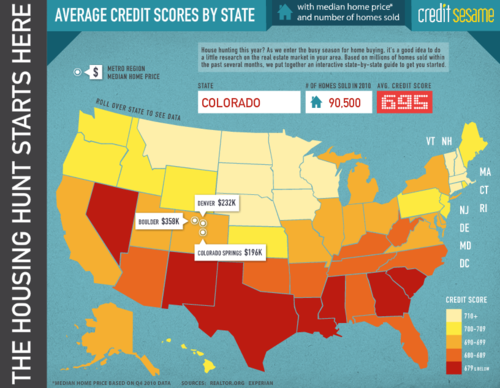

Credit Scores Around the Country [Interactive Infographic]

Tuesday, May 31st, 2011

(click on the map to go to the interactive graphic)

Do you know what your credit score is? Maybe you should try surviving the credit storm before you start buying houses…

(Via Column Five for Credit Sesame)

It’s All in the Wrist

Wednesday, May 25th, 2011

(credit: JASON ANFINSEN)

Going to Bonnaroo this year? Prepare to wear your credit card on your sleeve. Er, wrist. Concert producers have switched from a paper-based to a microchip-based ticketing system, which means you’ll be wearing your right to be there in a little plastic bracelet on your wrist.

But wait, there’s more! Concertgoers can also choose to embed their credit card information in their bracelets, so they’ll be able to pay for stuff without searching for their wallets. (We all know how much of a hassle that is, right?)

You’ve got to love how easy it’s becoming to spend money. Okay, maybe it’s not such a good thing for our budgets (or our souls) here in the U.S., but think about the implications for people who live in countries with developing economies… Technology like this could eliminate a lot of hurdles to economic participation – kind of like how the invention of the cell phone ended up democratizing long-distance communication in Africa. (In 2005, 1 in 11 Africans had a mobile plan; only 1 in 33 had a land line.)

Accounts Receivable is…

Wednesday, May 18th, 2011Accounts receivable (A/R) is an accounting term that refers to money someone owes to a store or business. If you buy something from a store, but don’t pay them right away – the amount that you owe goes into the store’s accounts receivable record.

Most large companies have an entire accounts receivable department that is solely focused on keeping track of money owed to the company.

Accounts Payable is…

Wednesday, May 18th, 2011Accounts payable (A/Ps) is an accounting term that refers to money owed by a person or business to another person or business.

For example, if an office has bottled water delivered each week but doesn’t pay for it until the end of the month, the charge goes into accounts payable until the check is written. Employee paychecks also fall into the category of accounts payable until they are actually given out to employees.

Does traveling (or living) well have to mean spending a lot of money?

Thursday, May 12th, 2011

(credit: notsogoodphotography)

We read the Frugal Traveler section of the New York Times from time to time, though frugality is not something all our members are familiar with. But today’s article about spending a weekend in Rio de Janeiro for less than $100 sounded like a lot of fun. The kind of fun you might miss if you spent $2,000 instead.

In this case, the writer has an amazing experience for less than a Benjamin because he’s open to new (and potentially uncomfortable) experiences. So why not make it a point to travel the road less recently paved now and then?

Think about what you really want. Is spending the only way to get it? Is brand-name really worth more to you than generic? Can you see as much of a new city from a high-rise as you can from the street?

Now take a look at your Spend page – what do you spend most of your money on? Is that what makes you happy?

It’s a Great Time to Be You: Pretty Young Professional Talks with TILE

Monday, May 9th, 2011Freaked out about your career? Amanda Pouchot and Kathryn Minshew from prettyyoungprofessional.com have been there, and they have some sage words of advice for you:

Check out Amanda and Kathryn’s other TILE appearances here.

>> TILE brings you exclusive opinions, explanations, and interviews from experts in every industry. Have a burning question or an expert you’d like to see interviewed? Just Ask TILE!