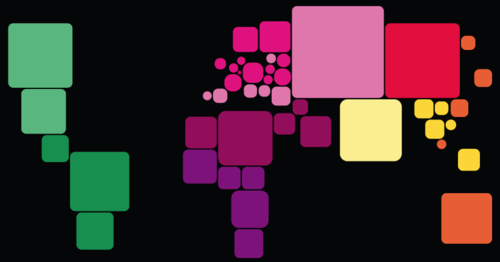

The financial times they are a’changing. At least, that’s what these new statistics would have us believe…

- In 2009, the American GDP (gross domestic product – a measurement of economic activity) dropped more than it had in sixty years. But like a phoenix made up of economic statistics, it rose back up in 2010.

- We can’t know the exact cause, but the numbers say that people earned a little more, saved a little less, and spent a little more than they had in recent years.

- Since consumer spending makes up almost three-quarters of all economic activity in the U.S., this is good news. But there are still those issues around high unemployment and a trashed housing market…

Facts & Figures

- Consumer spending represents 70% of all economic activity in the U.S.

- In 2010, spending rose by 3.5% – 0.7% of that was in December alone

- The last time spending rose that high was in 2007 (pre-recession)

What do you think?

Have you been spending more lately? Do you think the economy will recover faster depending on where you spend your money (at independent stores versus chains)?

(Check out this week’s Today at TILE for a closer look at signs of life in the economy.)