What would TILE look like if it were in the Wealth Education section of Citi Private Bank’s website? http://bit.ly/hM5lId

Archive for the ‘Public Home Page’ Category

Announcement: TILE on CPB Website

Tuesday, December 21st, 2010Today at TILE… Is microfinance too big to fail?

Thursday, December 2nd, 2010There has been a lot of press (mostly negative) about microfinance in India. A recent New York Times article highlights concerns such as poor lending practices, increased rates of borrower suicide, and a movement against making loan payments. (You can read how one of our Causes, ACCION, responded to the article here.) Some people are suggesting that these problems could mean the end of the microfinance industry as a whole. But no story is ever “black and white”, and in the world of finance it’s often possible to connect one crisis to another.

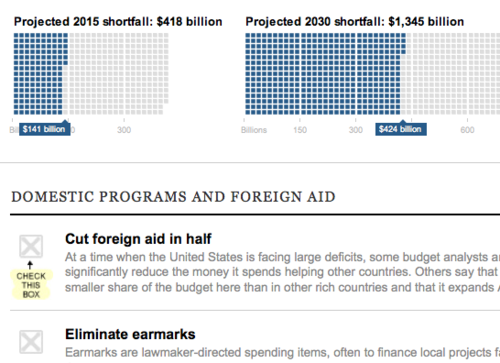

Fine, then. YOU fix the budget deficit.

Monday, November 22nd, 2010The New York Times is sick of reporting about all the different options for taking on our massive budget deficit, so it set its interactive feature monkeys to figuring out how to make you do it. They made this.

Super fun. See how easy it is to actually make decisions like cutting off Medicare benefits for the elderly. Raise taxes! Cut defense spending! Destroy NASAAAAAAAAAAAAA!

omg i just maxed out my ira!

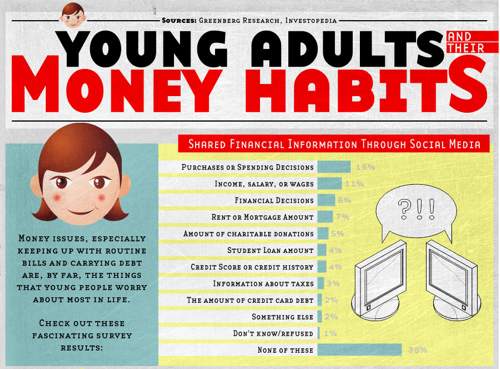

Wednesday, October 27th, 2010They say lifelong habits start early. But what does that mean when it comes to sharing financial information on social media sites? See the full report here (in a new window).

(via visualeconomics.com)

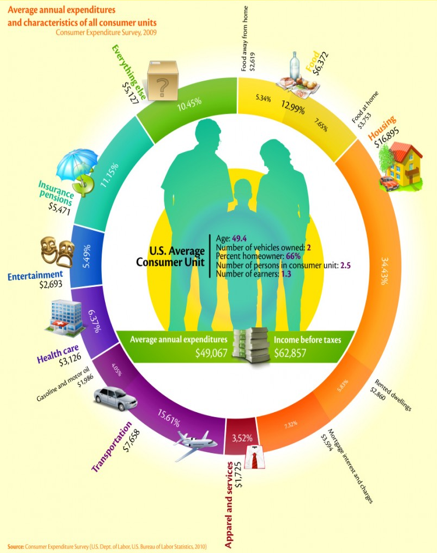

We’re a country of spenders, aren’t we?

Tuesday, October 19th, 2010SpendGrowGive helps you understand where your money goes. But do you ever wonder what the rest of America is spending on? As usual, there’s a handy infographic explaining it all! Click to see the full-size version in a new window.

(via creditloan.com)

Amy Butte on CNBC’s Strategy Session October 4th

Friday, October 1st, 2010Check out Amy’s appearance on CNBC’s Strategy Session! Part I: http://bit.ly/bsKyJc and Part II: http://bit.ly/9CdV2K

Today at TILE… Saving for the Low-Interested Generation

Thursday, September 30th, 2010Today at TILE we talked about saving money. What really comes to mind when you think about saving? Why is it a good thing to do? Is now a good time to start?

For many young adults in the TILE community, saving is kind of hard to get your head around. You know you should save, but you probably don’t have a lot of experience doing it. Maybe even the most basic components of savings, such as yield, risk, and time horizon, make you feel like a social psychology major in advanced physics or an English-only speaker in mainland China. It’s really not as hard as you think, though. We narrowed down the process to three steps: First, have money to save. Second, set up an account. Third, make a commitment to start saving now.

TILE Announcement: Reuters Article about SpendGrowGive

Thursday, September 30th, 2010Reuters just published a piece about how SpendGrowGive is helping bankers connect with the next generation of clients. Read it here: http://reut.rs/blStqQ

TILE Announcement: Partnership with Citi Private Bank

Thursday, September 30th, 2010TILE is proud to announce that Spend Grow Give is now available through Citi Private Bank.

Today at TILE… Credit Cards and College: A Thing of the Past?

Tuesday, September 14th, 2010Today at TILE we talked about heading back to school and about the banks that were lurking around the student center last semester. As we mentioned earlier, there are a whole bunch of new rules governing the way banks are allowed to operate, and this includes credit card companies. But how will these new rules impact your ability to get a card? Or the banks’ ability to give you one? Are back-to-school credit card offers a thing of the past? And is it good or bad that credit may be harder to come by for many young adults?

This year, there are new rules – specifically, the Credit CARD Act – which may put an end to banks soliciting you for new business. Card companies are no longer allowed to market credit cards within 1,000 feet of a college campus (kind of like a restraining order), are prohibited from hosting tables at events, and can’t give away “gifts” (you know, size XL t-shirts and teddy bears branded with the bank logo) to entice you to sign up. Maybe most importantly, if you are under 21, you can’t get a card at all unless you have a co-signer.