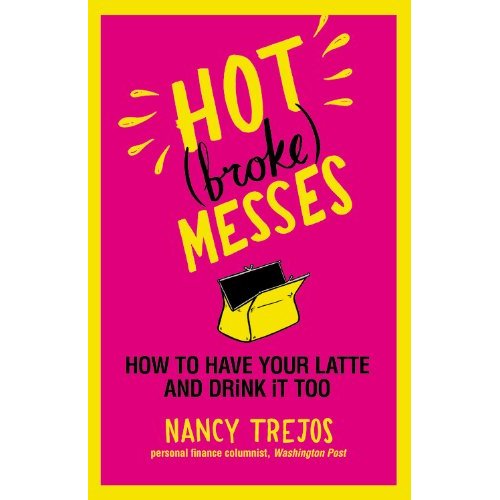

Our Canadian friends at The Globe and Mail reveal the latest trend in financial education:

Making personal finance books pink. You know, so girls will read them.

Harlequin, publisher of such romance classics as Alaskan Heat and Surrender to an Irish Warrior*, has already put out one book (The Frugalista Files: How One Woman Got Out of Debt Without Giving Up the Fabulous Life) and plans to publish more in the future.

Okay, we know men and women spend differently and even think about money differently. But will coloring personal finance books pink and talking about shoes really make finance matter for the ladies?

What do you think?

*Trahern MacEgan—his body is honed for fighting, his soul is black and tortured. Women want to tame him, but he has loved once, and now is lost. – eharlequin.com

*Trahern MacEgan—his body is honed for fighting, his soul is black and tortured. Women want to tame him, but he has loved once, and now is lost. – eharlequin.com