(photo credit: ezioman)

Let’s see if we can explain this one:

- The laws of supply and demand say that when supply of a particular product is low, its price goes up. And when consumer demand for that product is high, prices also go up.

- The opposite is also true: low demand = low prices; high supply = low prices.

- So when the oil minister of Saudi Arabia says that OPEC is cutting down on oil production because there’s too much supply in the market, you would think that oil is pretty cheap right now.

Nope. The price of oil is actually higher than it’s been in two and a half years. But it’s not high because of strong consumer demand (apparently demand is quite low since no one can afford it), and it’s not because of low supply (the minister says the market is actually “oversupplied” with barrels and barrels of black gold).

The price of oil is high because of the investors trading it on commodity markets. Because of all the civil unrest/ revolutions/ humanitarian disasters in North Africa and the Middle East right now, they’re worried about whether oil will become harder to get in the future.

So in this case, the price of oil has nothing to do with present-day supply and demand. It’s about a bunch of analysts who think that if a lot of oil-rich governments collapse, tomorrow’s supply might not meet tomorrow’s demand. (Dun dun dun dunnnnnnnnnn!)

April 21st, 2011

(photo credit: ezioman)

Let’s see if we can explain this one:

- The laws of supply and demand say that when supply of a particular product is low, its price goes up. And when consumer demand for that product is high, prices also go up.

- The opposite is also true: low demand = low prices; high supply = low prices.

- So when the oil minister of Saudi Arabia says that OPEC is cutting down on oil production because there’s too much supply in the market, you would think that oil is pretty cheap right now.

Nope. The price of oil is actually higher than it’s been in two and a half years. But it’s not high because of strong consumer demand (apparently demand is quite low since no one can afford it), and it’s not because of low supply (the minister says the market is actually “oversupplied” with barrels and barrels of black gold).

The price of oil is high because of the investors trading it on commodity markets. Because of all the civil unrest/ revolutions/ humanitarian disasters in North Africa and the Middle East right now, they’re worried about whether oil will become harder to get in the future.

So in this case, the price of oil has nothing to do with present-day supply and demand. It’s about a bunch of analysts who think that if a lot of oil-rich governments collapse, tomorrow’s supply might not meet tomorrow’s demand. (Dun dun dun dunnnnnnnnnn!)

April 21st, 2011

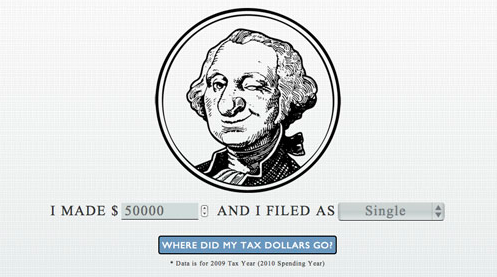

This is a pretty neat Eyebeam/ Google project. They offered money and fame (okay, just money) to the person who could come up with the best way to help you understand where your tax dollars are going, and then had a jury full of design types choose the best.

Click here to play with the “Grand Award Winner” of the interactive visualization competition, and see the rest of the winners and finalists here.

You just enter your approximate yearly income and your filing status, and the site estimates how much federal tax you’ll pay based on what tax bracket you’re in. Then it breaks down where all of that tax money you pay during the course of a year actually goes. For example, do you know how much of your paycheck goes toward funding the Department of Agriculture?

Do you even know what tax bracket you’re in? (If you don’t, you can find out here.)