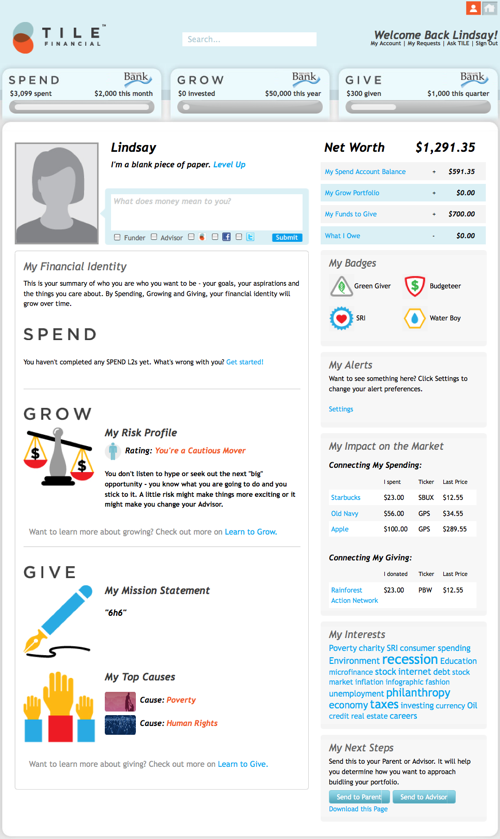

Hi! Here’s a quick tour of the bits and pieces that make up your Financial Identity Profile.

The Financial Identity Profile makes learning something you actually want to do. Just as your Facebook profile connects your social life, your Financial Identity Profile connects your financial life – using data from your financial accounts and your SPEND.GROW.GIVE. behavior.

First off, you can toggle between the profile and the home screen by clicking the person or house icons found in the top-right corner of every page.

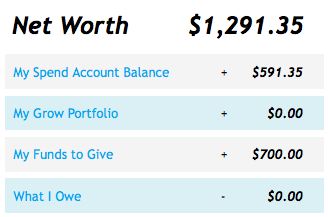

The page starts with your current net worth (which you won’t find anywhere else on the site) and a brief summary of your accounts. “What I Owe” refers to your credit card balance, if you have a card linked.

In the personal section on the left side of the screen, you can:

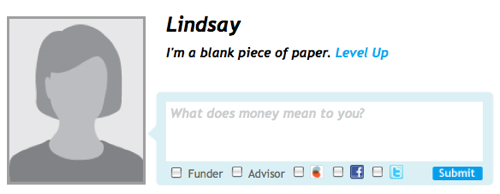

- - personalize your page by uploading a picture

- - see and change your financial learning level

- - send a message about your financial life to your funder/ parent, your financial advisor, TILE, or the world –via Facebook and Twitter

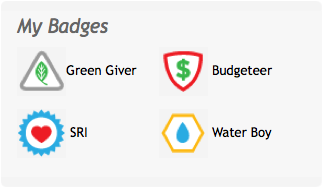

Want to level up? We give you loads of cool ways to get smarter about money. And when you do, you earn recognition for it.

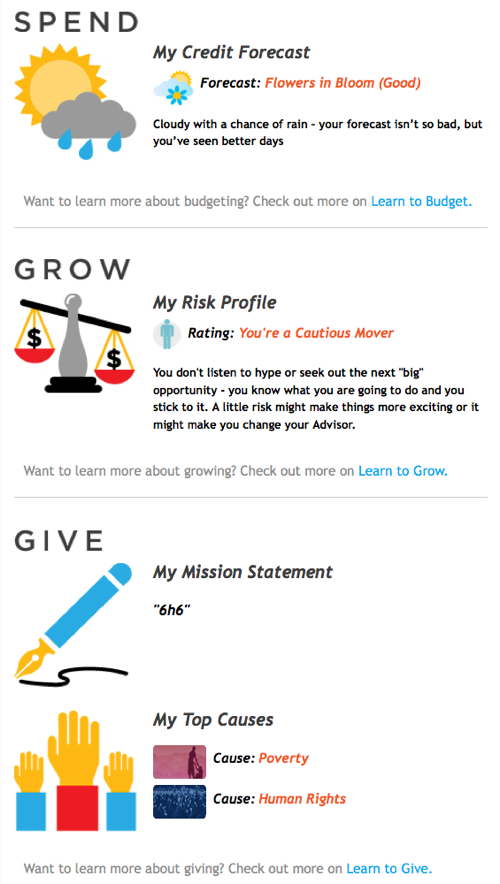

The Financial Identity box takes all of your SPEND.GROW.GIVE. activity and organizes it into a big picture of your financial life. Build it up by completing more Learn-Tos!

Get the same important account alerts on both the home page and your profile.

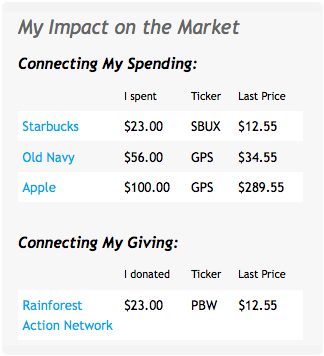

One of our favorite profile features is called “My Impact on the Market.”

It’s common now for people to get real time updates on their spending. But we’re taking this a big leap forward. If, for example, you spent money at Old Navy recently, we’ll show you that it’s part of a public company. And you can then learn about the stock.

We connect the dots between what you do every day and the market – taking away the cloud of secrecy. What’s more – you can now connect your charitable donations to the socially responsible funds that specialize in that cause. Interested in protecting the rainforest? Put your money where your heart is and consider how thoughtful investing might further your cause!

What articles do you like to click on? What topics do you read most about? We track your SPEND.GROW.GIVE. content behavior to show you where your financial interests actually lie.

If you want to share your profile with your parent (or funder) or your financial advisor, you can do so with just a click. But remember – it’s totally up to you. You control how much information is shared – or not – on SPEND.GROW.GIVE.

That’s it. If you need help with something else, read the Help page or Ask TILE. We’re here to help.

Now get out there and start building your financial identity!