Welcome to American Philanthropy! The charity scene has changed quite a bit in the past 100 years – from the elite ranks of oil barons to the democracy of text donations. Learning a little about the history of philanthropy in the U.S. will help you understand the present and future – and make you a smarter philanthropist.

American Philanthropy

May 31st, 2011American Philanthropy

May 31st, 2011Welcome to American Philanthropy! The charity scene has changed quite a bit in the past 100 years – from the elite ranks of oil barons to the democracy of text donations. Learning a little about the history of philanthropy in the U.S. will help you understand the present and future – and make you a smarter philanthropist.

Spending, Growing, and Giving in Warm Weather

May 31st, 2011

(credit: mandolin davis)

Your spending habits have changed in the past month, haven’t they? If you’re in the Northern hemisphere, you’re probably entering something called “summer,” which is a sure sign that wallets are creaking open after a long winter. Why? Well, basically, the days are longer, the sun is shinier, the calendar is overflowing with vacation days, and people are just generally having more fun. Which means more ways to spend that cash!

But it’s not just summer that has us pulling out our credit cards like a bunch of capitalist lemmings – the entire world economy changes with the seasons, and your money habits are a bigger part of that than you may think.

So here’s how it usually goes:

Spring & Summer = Spend

Besides the obvious expenses, like vacations and the new clothes you need now that you’re actually leaving your house in broad daylight, the warm-weather months just seem to tap into a spendy part of our brains. At least one study suggests that consumers consume more when they’re exposed to more hours of sunlight. Because they’re happier. And happy people like to buy stuff.

Fall & Winter = Grow

More specifically, Summer = sell stock & go on vacation; Fall & Winter = buy stock & hope it performs

There’s a saying on Wall Street – “Sell in May and Go Away.” It refers to a pattern of higher stock market returns from November to April and lower returns from May to October. So if your stock has done well all winter and you’re pretty sure it’s going to dip in the spring, you want to sell while it’s still high. And if you think the price is going to skyrocket again around Thanksgiving, you’ll want to snatch it up while it’s still low. Get it? Interestingly, no one can explain this pattern. (Though plenty of people are trying.)

December = Give

December is hands-down the biggest fundraising month for charities. Not only are people swept up in the generous holiday spirit (and probably feeling a little guilty about all the money they’re spending on pie and presents), but December is the last time to make tax-deductible donations for the year. And since many people don’t give much (or at all) during the rest of the year, the last week of December is when nonprofits see most of their donations pour in.

Everyone has a different reason for giving in winter, but a common one is that donors are busy going on vacation and spending money on themselves in the spring and summer. And who knows? Maybe there’s something about the bitterness of winter that makes people think more about world suffering.

But that’s just most people.

Do you see your own money behavior in any of these trends? More importantly, do you want to make your financial decisions based on the weather? After all, charities depend on donations year-round, and we all know you can’t really time the market.

If you’ve been unconsciously following the crowd, ask yourself: is this how you want to spend (grow, and give) your summer?

Spending, Growing, and Giving in Warm Weather

May 31st, 2011

(credit: mandolin davis)

Your spending habits have changed in the past month, haven’t they? If you’re in the Northern hemisphere, you’re probably entering something called “summer,” which is a sure sign that wallets are creaking open after a long winter. Why? Well, basically, the days are longer, the sun is shinier, the calendar is overflowing with vacation days, and people are just generally having more fun. Which means more ways to spend that cash!

But it’s not just summer that has us pulling out our credit cards like a bunch of capitalist lemmings – the entire world economy changes with the seasons, and your money habits are a bigger part of that than you may think.

So here’s how it usually goes:

Spring & Summer = Spend

Besides the obvious expenses, like vacations and the new clothes you need now that you’re actually leaving your house in broad daylight, the warm-weather months just seem to tap into a spendy part of our brains. At least one study suggests that consumers consume more when they’re exposed to more hours of sunlight. Because they’re happier. And happy people like to buy stuff.

Fall & Winter = Grow

More specifically, Summer = sell stock & go on vacation; Fall & Winter = buy stock & hope it performs

There’s a saying on Wall Street – “Sell in May and Go Away.” It refers to a pattern of higher stock market returns from November to April and lower returns from May to October. So if your stock has done well all winter and you’re pretty sure it’s going to dip in the spring, you want to sell while it’s still high. And if you think the price is going to skyrocket again around Thanksgiving, you’ll want to snatch it up while it’s still low. Get it? Interestingly, no one can explain this pattern. (Though plenty of people are trying.)

December = Give

December is hands-down the biggest fundraising month for charities. Not only are people swept up in the generous holiday spirit (and probably feeling a little guilty about all the money they’re spending on pie and presents), but December is the last time to make tax-deductible donations for the year. And since many people don’t give much (or at all) during the rest of the year, the last week of December is when nonprofits see most of their donations pour in.

Everyone has a different reason for giving in winter, but a common one is that donors are busy going on vacation and spending money on themselves in the spring and summer. And who knows? Maybe there’s something about the bitterness of winter that makes people think more about world suffering.

But that’s just most people.

Do you see your own money behavior in any of these trends? More importantly, do you want to make your financial decisions based on the weather? After all, charities depend on donations year-round, and we all know you can’t really time the market.

If you’ve been unconsciously following the crowd, ask yourself: is this how you want to spend (grow, and give) your summer?

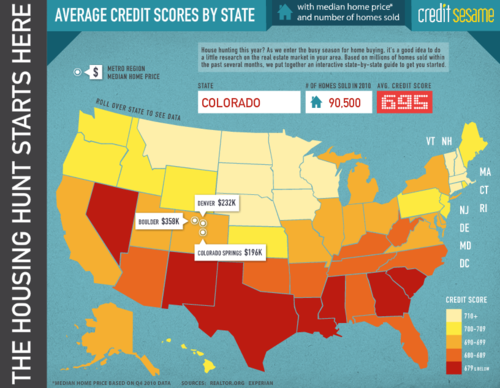

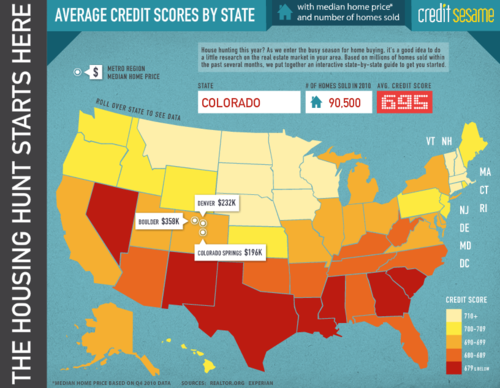

Credit Scores Around the Country [Interactive Infographic]

May 31st, 2011

(click on the map to go to the interactive graphic)

Do you know what your credit score is? Maybe you should try surviving the credit storm before you start buying houses…

(Via Column Five for Credit Sesame)

Credit Scores Around the Country [Interactive Infographic]

May 27th, 2011

(click on the map to go to the interactive graphic)

Are you surprised by the average credit score for your state? Do you know what your credit score is?

(Via Column Five for Credit Sesame)

One More Thing, Before You Go…

May 25th, 2011

(photo credit: bredgur)

It’s not often that the Wall Street Journal writes for readers under 40, but they just published a really good article with financial advice for the pre-college population. Now, we’re not trying to get all parenty on you, but as pseudo-grownups we can assure you that a little planning goes a long way.* (And it really doesn’t take that much time out of your schedule.) Here are some of the points writer Zac Bissonnette makes:

- > Debt becomes part of your life once you take it on. If you’re planning to use student loans to pay for school, remember that paying back those loans after graduation means part of every paycheck will belong to the bank.

- > Speaking of paying for college, do you really need to pay for an ivy league degree? Success doesn’t depend on which school you go to – it depends on the effort you put in.

- > Don’t get sucked in by materialism. The vast majority of people are not rich but still perfectly happy. But there are a lot of forces around you conspiring to make you feel poor and deprived. Tell them to go away.

(TILE Fun Fact: A small amount of debt can actually help you, by rounding out your credit history and boosting your credit score. But ONLY if you use it responsibly – that means pay it off, and never miss a due date.)

The most important question you need to ask yourself is this: What is this college degree really going to cost me, in terms of my dreams? Maybe you’d like to travel the world after graduation, or take an entry-level job in the nonprofit sector, or buy your first house before you’re thirty. Massive debt can really screw up your plans, so plan accordingly.

* For example, if you chose to invest $1,000 at age 18 and earned a paltry 3% return, you could have $3,500 waiting for you when you’re 60. (And by the time you’re 60, 60 will be the new 30.) All that with absolutely no effort. Well, you do have to take an hour to invest that $1,000 when you’re 18. See what we mean about planning?

One More Thing, Before You Go…

May 25th, 2011

(photo credit: bredgur)

It’s not often that the Wall Street Journal writes for readers under 40, but they just published a really good article with financial advice for the pre-college population. Now, we’re not trying to get all parenty on you, but as pseudo-grownups we can assure you that a little planning goes a long way.* (And it really doesn’t take that much time out of your schedule.) Here are some of the points writer Zac Bissonnette makes:

- > Debt becomes part of your life once you take it on. If you’re planning to use student loans to pay for school, remember that paying back those loans after graduation means part of every paycheck will belong to the bank.

- > Speaking of paying for college, do you really need to pay for an ivy league degree? Success doesn’t depend on which school you go to – it depends on the effort you put in.

- > Don’t get sucked in by materialism. The vast majority of people are not rich but still perfectly happy. But there are a lot of forces around you conspiring to make you feel poor and deprived. Tell them to go away.

(TILE Fun Fact: A small amount of debt can actually help you, by rounding out your credit history and boosting your credit score. But ONLY if you use it responsibly – that means pay it off, and never miss a due date.)

The most important question you need to ask yourself is this: What is this college degree really going to cost me, in terms of my dreams? Maybe you’d like to travel the world after graduation, or take an entry-level job in the nonprofit sector, or buy your first house before you’re thirty. Massive debt can really screw up your plans, so plan accordingly.

* For example, if you chose to invest $1,000 at age 18 and earned a paltry 3% return, you could have $3,500 waiting for you when you’re 60. (And by the time you’re 60, 60 will be the new 30.) All that with absolutely no effort. Well, you do have to take an hour to invest that $1,000 when you’re 18. See what we mean about planning?

Play with your own numbers to see what a little investment today can earn you: Compound Interest Calculator

It’s All in the Wrist

May 25th, 2011

(credit: JASON ANFINSEN)

Going to Bonnaroo this year? Prepare to wear your credit card on your sleeve. Er, wrist. Concert producers have switched from a paper-based to a microchip-based ticketing system, which means you’ll be wearing your right to be there in a little plastic bracelet on your wrist.

But wait, there’s more! Concertgoers can also choose to embed their credit card information in their bracelets, so they’ll be able to pay for stuff without searching for their wallets. (We all know how much of a hassle that is, right?)

You’ve got to love how easy it’s becoming to spend money. Okay, maybe it’s not such a good thing for our budgets (or our souls) here in the U.S., but think about the implications for people who live in countries with developing economies… Technology like this could eliminate a lot of hurdles to economic participation – kind of like how the invention of the cell phone ended up democratizing long-distance communication in Africa. (In 2005, 1 in 11 Africans had a mobile plan; only 1 in 33 had a land line.)

Synergy is…

May 24th, 2011Synergy, besides being one of those infamous “corporate buzzwords,” is the combination of at least two things (for example companies or organizations) to produce a financial benefit that’s greater than the sum of its parts.

For example, by purchasing one company, another company might be able to generate more revenue than both companies would have been able to generate if they kept operating separately. (Think Graham Crackers Inc. and Melty Marshmallows LLC being acquired by Hershey’s.)