Today at TILE we asked the question, “Has anything really changed for the banks since the financial crisis?” If you were ever punished by your parents or a teacher for misbehaving, did you really see the error of your ways and change? Or did you just go back to doing what you did before (and hope not to get caught next time?)

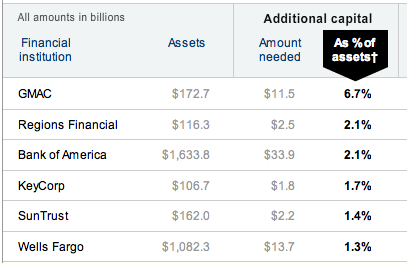

The Federal Reserve introduced “Stress Tests” to measure: 1) How much more money could banks lose if the economy got worse? and 2) How much more capital would they need to sustain a worst-case scenario? The worst-case scenario assumptions include unemployment rising to 10.3% (versus 8.6% today) and a 22% further decline in housing prices (as compared to a 29.1% decline since 2006.) Looking at the 19 largest banks, the Fed estimates they could lose up to $600 billion if things get worse and the banks will need to raise another $75 billion to get to a “comfort level.” For example, they estimate Bank of America could lose another $137 billion in a worst case scenario and they’ll need an additional $34 billion in capital to get to a comfort level. The table below gives you the details for each bank reviewed. (click the image for an interactive version)

The objective of the Federal Reserve (and the government, in general) is to make sure that the U.S. financial system is sound – that banks have enough capital (or resources) so that your deposits are safe and that they have enough capital to start lending again. Confidence and action together help the economy grow. For example, if you feel confident that your money will be safe, you will put it in the bank. Using your deposits, the bank can then lend to others. If the banks use leverage (e.g. for each dollar on deposit, they can lend out 10x that), then even more money circulates in the economy.

So, after these Stress Tests and after the big banks raise more capital… are we really in better shape? We know they lost a lot of money in the first place by making bad decisions (e.g. bad loans, bad trades, and poor risk management). We know they raised or are raising more capital. We know that the government says a Tier 1 Capital Ratio of 6% should give us confidence (this measures Available Common Equity as a percentage of Risk Weighted Assets – in other words Do you have enough money to cover your “bets”?) We know that people and markets are feeling upbeat lately – after all the S&P is up almost 26% since the beginning of the year.

What we don’t know is if the banks have really changed their ways. Are we providing taxpayer and investor dollars just so they can lose it again? Are decisions at these firms being made any differently? Beyond having less money to trade, lend, and invest, are there any new “checks and balances” in place? In the 1600s there was a tulip bulb craze in Holland where people were willing to pay $76,000 for a single tulip bulb! This is probably the best example of a “bubble” which inevitably burst – today we think it is silly for happening. Unfortunately, more bubbles have happened – the Internet Bubble in 2000, the Telecommunications Bubble in 2001, and the Real Estate Bubble of 2008. The banks were involved with all of them – so can we really believe they’ve learned their lesson this time?

What does this mean for the TILE Community? Well, if your bank failed their “stress test” you may want to watch to see if they raise the extra capital they need. Even if they didn’t fail the test, banks may still be reluctant to lend money for a while (for fear of failing in the future.) If you failed a Physics 101 test, you’re probably going to be a little reluctant to sign up for Advanced Physics next semester.

Even if your bank passed the test, pay attention to what they do and not just what they say. Is it easier or harder for you to get a credit card? A loan? Are they paying you more or less interest on your deposits? Is the service level higher or lower? Probably faster than the government, you will know how the banks are doing – just by how they interact with you!

- Amy