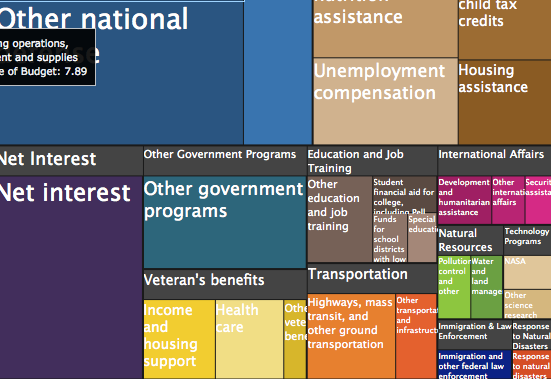

The United States Budget Proposal for 2012

Click on the image to see the whole thing.

What would YOUR budget look like if it were stuck into a sweet infographic?

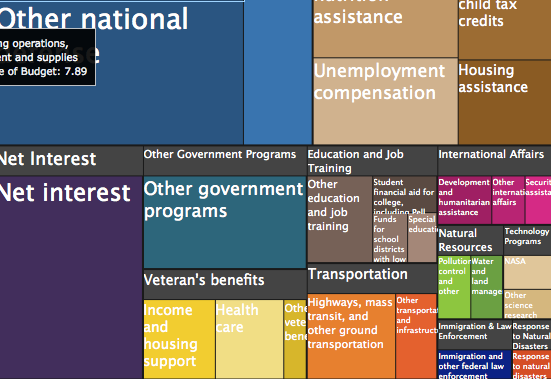

The United States Budget Proposal for 2012

Click on the image to see the whole thing.

What would YOUR budget look like if it were stuck into a sweet infographic?

It’s bold, it’s risky, it’s the 2011 United Kingdom budget!

“We have had to make choices, choices in the things we support. We have taken our country back from the brink of bankruptcy.” – George Osborne, Chancellor of the Exchequer

If you’ve ever received a paycheck, you’ve probably noticed that a big chunk of your earnings go to Uncle Sam. The government collects trillions of dollars in taxes every year. There are different types of taxes, such as income tax and property tax, but all funds collected are ultimately spent by the government.

In 2004, the federal budget was approximately $2 trillion. Here is a breakdown of how that money was spent:

You can get much more detailed information by visiting government agency websites like the Congressional Budget Office.

In absolute numbers, the U.S. gives by far the most money in Official Development Assistance (ODA) – in 2008 it was nearly twice that of the next biggest donor, Germany. Compared to how much money we have, however, the U.S. actually gives the least of any developed country. Does this mean Americans are the least generous people of all the nations of the industrialized world? Hardly. ODA is just foreign aid give by governments under the watch of the OECD (Organization for Economic Co-operation and Development). It doesn’t take into account private contributions from individuals, foundations, and other institutions.

American people, foundations, and institutions send more money and aid abroad than private citizens and organizations in any other developed country in the world by far. Why? It might be easier to understand by examining why people in other countries give less. In Europe – where most of our fellow developed countries are located – there are tons of big social programs based on the philosophy that the government should take care of the poor and other issues that Americans generally think should be taken care of by private individuals, religious organizations, and stuff like that. In order to pay for these big social programs, these countries have equally big taxes. Even more so, the U.S. gives tax breaks to people who give to charity – almost paying you to give money away.

Living under the assumption that the government should pay for all social ills, and having less money to give away because of higher taxes isn’t a recipe for huge private donations.