Socialism is a system where everything is communally owned, meaning that it’s shared by everyone. In a socialist community, people share all property, all business, and all products, instead of each person owning their own things. In socialism, the objective is for everyone in society to be equal, so no one ends up any richer or poorer than anyone else.

Posts Tagged ‘government’

The European Union is…

Friday, June 3rd, 2011The European Union is a political and economic organization made up of 27 countries in Europe. It’s not a country by itself, but in some ways it acts as a high-level governing organization for its member nations. Being part of the Union means that citizens, goods, and services are allowed to move freely between affiliated nations, without having to deal with things like visas or trade restrictions. Members of the EU also use the same currency, called the Euro.

Basically, being part of the European Union is like being in a club whose members are from all over Europe and who have decided that many of the same rules will govern every member – despite their differences in nationality. But not every European nation is a member of the EU (Switzerland, for example), and some member nations have not yet adopted the official currency (the United Kingdom still uses the Great British Pound).

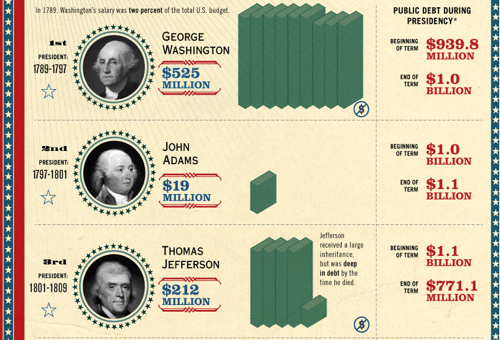

Debt and the Presidents of the United States

Friday, April 15th, 2011If you’ve ever watched the news, you probably know that every problem facing our nation is all one person’s fault: the president.

Well, that’s probably not fair.

This neat-o infographic shows the net worth of every U.S. president and the national debt when they entered and left office. It’s a great perspective during this particular time of budget crisis and finger-pointing.

Do you see any patterns? Is the federal deficit tied to a president’s money-management skills? Wealth? Or something entirely different (like, uh, wars and recessions)?

(via credit sesame)

If we need more money, why can’t the government just print more?

Government Accountability Office Finds 56 Different Federal Programs for Helping People Understand Finance

Wednesday, March 9th, 2011“The GAO examined numerous federal agencies, including the departments of defense, agriculture and housing and urban development, and pointed to instances where different arms of the government should be coordinating or consolidating efforts to save taxpayers’ money.

The agency found 82 federal programs to improve teacher quality; 80 to help disadvantaged people with transportation; 47 for job training and employment; and 56 to help people understand finances, according to a draft of the report reviewed by The Wall Street Journal.”

What do you think?

Have any of these fifty-six programs helped YOU? How about SPEND.GROW.GIVE?

Let us know at ask@tilefinancial.com!

The Government Says Your Life Is Worth Saving…

Thursday, March 3rd, 2011“WASHINGTON — As the players here remake the nation’s vast regulatory system, they have been grappling with a subject that is more the province of poets and philosophers than bureaucrats: what is the value of a human life?

The answer determines how much spending the government should require to prevent a single death.

To protests from business and praise from unions, environmentalists and consumer groups, one agency after another has ratcheted up the price of life, justifying tougher — and more costly — standards.

The Environmental Protection Agency set the value of a life at $9.1 million last year in proposing tighter restrictions on air pollution. The agency used numbers as low as $6.8 million during the George W. Bush administration.”

What do you think?

How much is YOUR life worth? (We’re not just talking about your net worth, either!)

Congressional Staff Profit From Suspicious Trades

Monday, October 11th, 2010If you invest because you know a government bill benefiting a certain industry is going to pass soon, does that make you an inside trader?

- You may be surprised to learn that insider-trading laws don’t apply to Congress. Some lawmakers have tried to change that with the STOCK (Stop Trading on Congressional Knowledge) Act, but there hasn’t exactly been a lot of momentum to get that law passed.

- The Wall Street Journal went through financial records of Congressional aides and found that many were trading in stocks whose prices were directly or indirectly impacted by the legislative activities of their bosses. The finance and energy sectors were especially popular among Congressional traders.

- Because aides don’t technically make the decisions that determine whether laws are passed, some say there is no real conflict of interest. But both members of Congress and the highest-paid Congressional aides (about 11% of all aides) are required to make the details of their personal finances public.

Facts & Figures

- In 2008 and 2009, 72 Congressional aides have traded stock in companies overseen by their bosses

- Some of the higher-paid aides earn salaries of $170,000 per year

Best Quote

“Congressional staff are often privy to inside information, and an unscrupulous person could profit off that knowledge. The public should be outraged there is no law specifically banning this.” – Vincent Morris, Spokesman for Rep. Louise Slaughter (D., N.Y.)

The Rocky Relationship Between Philanthropy And Government

Tuesday, June 29th, 2010The federal government and philanthropic programs have always struggled to get along, but they’re trying to put their differences aside to help programs grow.

- The government sometimes has a hard time following through on promised funding to nonprofits. For example, $50 million that might have been allocated to Teach for America’s 2011 budget met calamity when political pressure cut the funds completely.

- Program funding is moving away from direct government disbursements and toward foundations with grant applications and matching programs.

- As budgets are expected to tighten, the relationship between philanthropy and the government will only become more complicated.

Facts & Figures

- Teach for America received $18 million in the 2010 federal budget.

- The Investing in Innovation Fund, run by the Department of Innovation, gives up to $50 million to education programs that are able to match 20% of the grant with private money.

- 12 foundations have pledged over $500 million that they will use to either match winners or help programs that do not win government money from the fund.

Best Quote

“Partnership with government is going to continue to be hard. We should pursue it but with a sober recognition there will be curves ahead on the road that you can’t see coming.” – David Gergen, Professor at Harvard’s Kennedy School of Government

Savings Bonds are…

Friday, June 18th, 2010Savings bonds are government-issued debt securities (doled out by the U.S. Department of the Treasury) that help pay for the U.S. government’s borrowing needs. They are supplied in face-value denominations from $50 – $10,000, with local and state tax-free interest and semiannually adjusted interest rates. Savings bonds are considered to be among the safest of investments, as they are backed by the U.S. government.

How Much Power Should We Give The Fed?

Tuesday, August 18th, 2009How big should government be? Below, the Fed chairman’s arguments for why, when it comes to consumer protection, bigger is better.

- Federal Reserve chairman Ben S. Bernanke has been spurring debate about the Fed’s proper role, arguing that it is necessary to give the government more authority.

- Bernanke wants the Fed to maintain control over consumer lending, an opinion which differs from the policies of the Obama administration.

- Many officials are skeptical of this plan, arguing that the government is already spread too thin, and that it cannot possibly become a successful systemic risk regulator.

Facts & Figures

- Bernanke’s plan requires the government to examine the possible dangers posed not just by companies themselves, but by their connections to other corporations.

- The Fed would also require big corporations to keep debt low or capital high, restricting them to a manageable size and increasing competition.

- The government would be granted the authority to seize any institution it deemed too great a danger to the financial system.

Best Quote

“…[T]here’s got to be somebody who is responsible not just for monitoring the health of individual institutions, but somebody who’s monitoring the systemic risks of the system as a whole. And we believe the Fed has the most technical expertise and the best track record in terms of doing that.” – Barack Obama